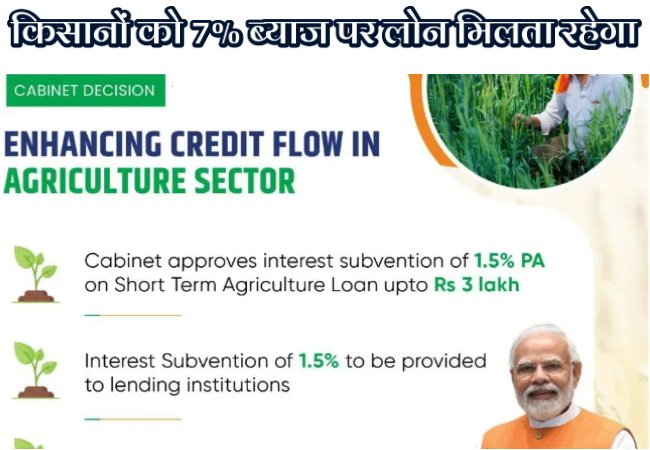

The Union Cabinet, chaired by the Prime Minister Shri Narendra Modi, has approved the continuation of the Modified Interest Subvention Scheme (MISS) for the financial year 2025-26. This decision ensures that farmers will continue to receive short-term agricultural loans at an affordable interest rate, significantly boosting the rural credit ecosystem and agricultural growth.The Government of India has reaffirmed its commitment to supporting the nation’s agricultural sector by extending the Modified Interest Subvention Scheme (MISS) for the financial year 2025-26. This pivotal decision ensures that farmers will continue to benefit from access to short-term agricultural loans at an exceptionally low interest rate of 7% per annum, which can effectively be reduced to just 4% upon timely repayment. This scheme, primarily channeled through the Kisan Credit Card (KCC), is a cornerstone of rural financial inclusion, designed to provide affordable institutional credit to farmers, thereby boosting agricultural productivity and alleviating rural debt. The continuation of MISS underscores the government’s strategic focus on strengthening the financial backbone of farmers and fostering sustainable growth in the agricultural and allied sectors.

What is the Modified Interest Subvention Scheme (MISS)?

The Modified Interest Subvention Scheme (MISS) is a Central Sector Scheme of the Government of India. Its primary objective is to make short-term credit available to farmers at an affordable interest rate through institutional credit, mainly via the Kisan Credit Card (KCC). The scheme was originally introduced in 2006-07 to improve credit availability and reduce rural indebtedness.

Key Features of MISS for FY 2025-26:

- Subsidized Interest Rate for Farmers: Farmers can avail short-term agricultural loans of up to ₹3 lakh at a subsidized interest rate of 7% per annum.

- Interest Subvention to Banks: The Government of India provides an interest subvention (subsidy) of 1.5% to the lending institutions (Public Sector Banks, Private Sector Banks, Regional Rural Banks – RRBs, and Cooperative Banks) for these loans. This 1.5% is borne by the government, effectively reducing the lending cost for banks, allowing them to offer loans at 7% to farmers.

- Prompt Repayment Incentive (PRI): An additional incentive of 3% is provided to farmers for prompt and timely repayment of their loans. This means if a farmer repays the loan within the stipulated period (typically one year from the date of advance), the effective interest rate for them is further reduced to 4% per annum (7% – 3% = 4%).

- Coverage: The scheme primarily covers short-term crop loans. It has also been extended to include working capital for allied agricultural activities like animal husbandry and fisheries, with the interest benefit applicable for loans up to ₹2 lakh in these sectors.

- Continuation of Support: The Cabinet’s approval ensures that the existing provisions of MISS, including the 1.5% interest subvention, will continue for FY 2025-26. The government has allocated ₹15,640 crore to support this scheme for the current financial year.

- Digital Reforms: The launch of the Kisan Rin Portal (KRP) in August 2023 has enhanced transparency and efficiency in the processing of interest subvention claims, benefiting both farmers and banks.

- Enhanced Loan Limit (Budget 2025-26): While the primary loan limit under MISS is ₹3 lakh for crop loans, the Union Budget 2025-26 also announced a proposal to enhance the KCC limit to ₹5 lakh for broader agricultural needs, which is under active consideration.

- Support during Natural Calamities: In cases of natural calamities, an interest subvention of 2% is available to banks for the first year on restructured crop loans for affected farmers.

How Farmers Can Get the Benefit:

The benefits of the Modified Interest Subvention Scheme are primarily accessed through the Kisan Credit Card (KCC) scheme. Here’s how farmers can avail these subsidized loans:

Obtain a Kisan Credit Card (KCC):

If you don’t already have one, apply for a KCC at any of the eligible lending institutions: Public Sector Banks, Private Sector Banks, Regional Rural Banks (RRBs), or Cooperative Banks.

Eligibility for KCC:

- Farmers (individual/joint borrowers) who are owner cultivators.

- Tenant farmers, share croppers, and oral lessees.

- Self-Help Groups (SHGs) or Joint Liability Groups (JLGs) of farmers.

- Farmers involved in allied agricultural activities like animal husbandry and fisheries.

- Documents for KCC Application: Generally include identity proof (Aadhaar, PAN), address proof, land records (Patta, Khasra, Khatauni), and a passport-sized photograph. The bank will also assess the farmer’s cropping pattern and credit requirements.

Apply for Short-Term Agricultural Loan:

Once you have a KCC, you can apply for a short-term agricultural loan (for crop cultivation, post-harvest expenses, working capital for allied activities, etc.) up to ₹3 lakh (or ₹2 lakh for animal husbandry/fisheries) from your bank.

The bank will process your loan application and sanction the amount.

Avail 7% Interest Rate:

- When the loan is disbursed, the initial interest rate charged to the farmer will be 7% per annum. The 1.5% interest subvention from the government to the bank ensures that the bank can afford to lend at this rate.

- Benefit from 4% Effective Interest Rate through Prompt Repayment:

- To get the additional 3% Prompt Repayment Incentive (PRI), farmers must ensure they repay their short-term loan on or before the due date (typically within one year from disbursement).

- Upon timely repayment, the 3% incentive will be credited back to the farmer’s account, reducing the effective interest rate paid by the farmer to 4% per annum.

Utilize Kisan Rin Portal (KRP):

- While farmers apply through banks, the Kisan Rin Portal (KRP) is a digital platform that brings together farmers, banks, and government schemes. It aims to streamline the loan application and subvention claim process. Farmers may use this portal to track their loan status and subvention claims.

Broader Impact and Significance of the Scheme Extension

The extension of the Modified Interest Subvention Scheme (MISS) for FY 2025-26 holds significant importance for the Indian agricultural sector:

- Boost to Agricultural Productivity: Affordable credit enables farmers to purchase necessary inputs like quality seeds, fertilizers, pesticides, and access modern farming equipment. This directly contributes to increased agricultural productivity and output.

- Reduced Indebtedness: By offering loans at a very low effective interest rate (4% for prompt payers), the scheme helps in reducing the burden of debt on farmers, preventing them from falling into the trap of high-interest informal credit sources.

- Promotion of Timely Repayment Culture: The 3% Prompt Repayment Incentive actively encourages farmers to repay their loans on time, which is crucial for maintaining the financial health of lending institutions and ensuring a continuous flow of credit to the agricultural sector.

- Financial Inclusion: The scheme, primarily channeled through the KCC, promotes financial inclusion by bringing more farmers into the formal banking system. This provides them with access to institutional credit, safeguarding them from exploitative moneylenders.

- Support for Diversification: Extending the interest subvention to allied activities like animal husbandry and fisheries encourages farmers to diversify their income sources, making them more resilient to climate change and market fluctuations. These sectors are crucial for supplementary income for many small and marginal farmers.

- Enhanced Bank Lending to Agriculture: The 1.5% interest subvention provided to banks incentivizes them to lend more to the agricultural sector, as it compensates for the lower interest rates charged to farmers and reduces the risk associated with agricultural lending. This ensures adequate credit flow to the sector.

- Macroeconomic Stability: A healthy agricultural sector, supported by accessible credit, contributes to overall economic stability, ensures food security for the nation, and supports rural livelihoods.

Recent Developments and Future Outlook

The Indian government has been consistent in its efforts to streamline agricultural credit and ensure its reach to all eligible farmers.

- Kisan Rin Portal (KRP): The launch of KRP is a major digital reform. This integrated portal helps track the progress of KCC loans, facilitates the processing of interest subvention claims by banks, and provides greater transparency. For farmers, it offers a single window to view their credit history and benefits.

- Ghar Ghar KCC Abhiyan: Campaigns like the ‘Ghar Ghar KCC Abhiyan’ have been launched to achieve saturation in KCC coverage, ensuring that every eligible farmer has access to formal credit. This grassroots effort aims to bring more farmers into the ambit of institutional credit and schemes like MISS.

- Focus on Small and Marginal Farmers: The scheme’s design, with a focus on loans up to ₹3 lakh, particularly benefits small and marginal farmers who constitute the majority of the farming community in India and are most vulnerable to credit shortages.

- Budgetary Support: The significant budgetary allocation for MISS (₹15,640 crore for FY 2025-26) demonstrates the government’s strong financial commitment to this scheme, assuring its continuity and effectiveness.